Decoding Your Credit Report

When it comes to securing an auto loan or mortgage, your financial track record plays a pivotal role. Your credit report offers banks and lenders insights into your suitability as a borrower, assessing the likelihood of you repaying the borrowed funds based on your financial history.

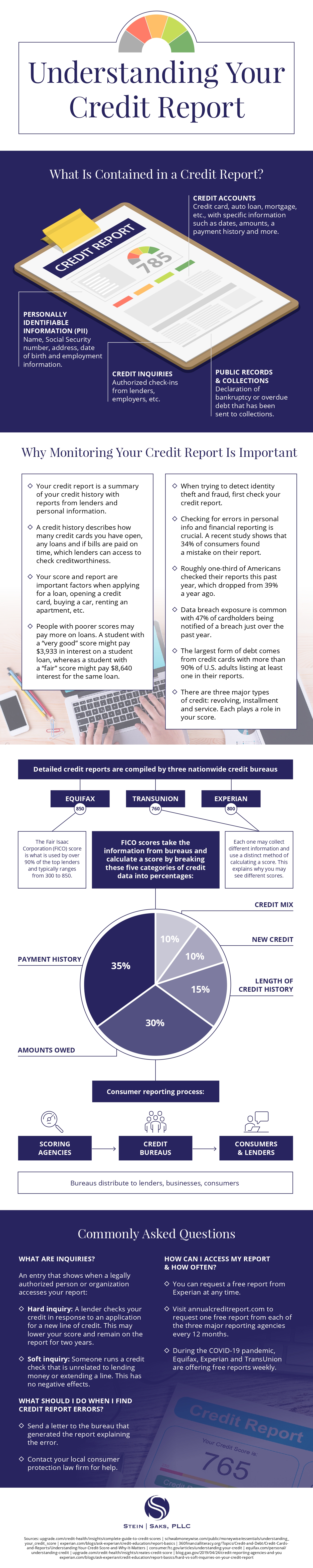

While the credit score is a familiar concept, it is an amalgamation of various data points extracted from your past activities. While it provides a quick overview of your financial standing, it does not convey the complete narrative.

Grasping the intricacies of your credit report holds significance for multiple reasons. It not only offers a more nuanced perspective of how lenders perceive you but also serves as a guide for making informed decisions about your spending habits.

Your credit report presents a comprehensive history of your credit cards, loans, and bills, highlighting how promptly or belatedly you have repaid them. For instance, even if you believe your financial standing is sound, a pattern of late payments could impact your ability to secure a new car loan or rent an apartment. Identifying such patterns on your report provides an opportunity to rectify any lapses and work towards improving your credit score.

There is no concealment of your financial life from credit-granting institutions. It is essential for everyone to be cognizant of the information reflected in their credit reports and comprehend its implications. For further insights, explore the accompanying resource.

This infographic was created by Stein Saks, a credit report dispute attorney